cheaper car insurance low cost auto auto insurance insured car

cheaper car insurance low cost auto auto insurance insured car

Most of these policies will certainly also cover the personal usage of your automobiles, as well as those risky void times when you are on the clock yet still not covered - credit. If you are a rideshare vehicle driver, rideshare insurance policy is for you.

Costs for rideshare insurance coverage policies can differ considerably from provider to company as well as will depend on a series of individual elements like credit report, driving history, as well as area as well. Maintaining that in mind, a rideshare insurance coverage plan might set you back just $10 a month to upwards of dual the price of a typical personal auto insurance plan (car insured).

"I can't get over exactly how easy the procedure of searching for even more economical insurance was with Jerry! I have a clean driving record as well as could not comprehend why my insurance policy expenses maintained going up.

Neither the rideshare company insurance coverage nor your basic plan will completely cover you throughout the duration where you are on the work but have not yet accepted a ride or delivery demand. Also if you are associated with an accident in among the durations that is fully covered by the standard Uber or Lyft company insurance policy and you require to file a claim, you will likely be responsible for paying a $2500 insurance deductible. car.

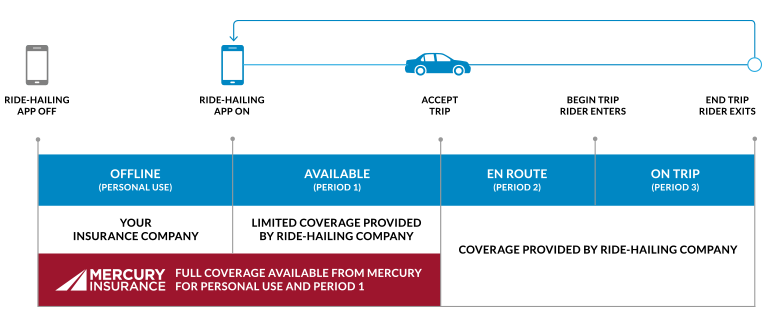

Uber as well as Lyft insurance by period In the situation of Uber or Lyft, the business insurance plan either begins or does not begin according to a designated period of the trip that you remain in the process of completing. The system functions as complies with: This period covers any time when the rideshare app is not activated. auto insurance.

Rideshare Insurance Irvine, California - Find Affordable ... Things To Know Before You Buy

This duration refers to the details period where your app is switched on but you are still waiting for or have not yet approved a customer request - insure. This is the gap duration where you are not covered by your conventional individual insurance coverage or the rideshare app plan. If your firm insurance plan gives coverage now, it will be really limited.

As soon as you accept a ride request and also head out toward your collection location, your rideshare business insurance plan will fully enter into result. insurance companies. As soon as you select up a guest as well as have them in your auto, you are still fully covered by your rideshare business's insurance bundle till the ride is significant complete.

affordable car insurance liability affordable car insurance affordable

affordable car insurance liability affordable car insurance affordable

This is where rideshare insurance policy covers the voids. automobile. You will be covered by the very same constantly strong plan regardless of whether you get on or off the job at any certain time. Distribution service insurance policy by period If you are driving for a shipment app solution, it is very important that you spend some time to take a look at your business car insurance coverage to learn exactly what you are covered for and what isn't covered.

During this period, you will certainly be covered by your individual insurance coverage. This duration describes the certain time duration where your app is transformed on but you are still awaiting or have not yet approved a shipment request. cheaper car. Throughout this space period, you might not be covered by either your standard personal insurance coverage or the shipment application's plan.

cheap laws auto cheaper

cheap laws auto cheaper

Several chauffeurs will require a supplementary rideshare insurance coverage to see to it they are covered during this in-between period. Unlike Uber or Lyft, not all delivery app business will supply you with company insurance when you are driving to pick up a shipment but haven't received the item yet. In some instances, when you accept a request as well as go out toward your set location, your shipment app firm insurance coverage will fully or partly entered into effect. accident.

More About Why Every Uber Or Lyft Driver Needs Rideshare Insurance

If your business does not offer insurance coverage, you will be left susceptible must you be entailed in an accident while supplying an item. As you can see from above, numerous distribution app chauffeurs can possibly be left uninsured at any kind of duration of the process. At other times, you could only receive limited protection by your business insurance policy if whatsoever.

vans dui affordable car insurance

vans dui affordable car insurance

State Ranch rideshare insurance coverage is readily available in virtually every state (with a couple of exemptions) and does not included any kind of pesky strings like mileage restrictions attached - low cost. If you work for both a rideshare service and delivery app solution like Uber, Eats, you can prolong your protection without needing to fret about paying a higher costs.

The Allstate rideshare insurance coverage operates as an add-on to an existing exclusive automobile insurance coverage. suvs. Essentially, ought to you be involved in a crash while in any of the periods covered by your rideshare company plan, the personal rideshare add-on will aid you cover the distinction in between the business deductible and Allstate's much lower average deductible of about $500.

On the drawback, you have to have an existing Allstate auto insurance coverage in position in order to subscribe and also Allstate does not assure that you will certainly be covered when you are on the work, so you still may be left vulnerable throughout the gap periods while working (vans). Progressive's rideshare insurance policy coverage, The noteworthy feature of Progressive's rideshare insurance policy bundle is that it is just one of the most customizable rideshare insurance intends offered.

For instance, they account for "on" and "off" seasons of the year while appreciating the comfort of recognizing that you will certainly be covered year round without paying too much for your protection. The drawback to the Modern rideshare plan is that the rates system is not really clear and it is extremely customized, making it hard to properly value out alternatives when you compare cheap car insurance prices quote.

Do I Need Rideshare Insurance When Driving Others For Profit? Can Be Fun For Anyone

It is a great suggestion to have the complying with documents handy ought to they be called for: Any pertinent Rideshare firm certification, A duplicate of the Rideshare firm policies, Proof of your individual insurance policy, While awaiting the authorities to get here, if possible, exchange any kind of appropriate details with the various other chauffeur. This should consist of the following: Legal name, Call info, Insurance information, Contact your individual insurance policy company as quickly as possible (affordable).

Rideshare insurance policy has actually become increasingly preferred in the last few years with the development of firms like Uber and also Lyft. If you're functioning for a rideshare firm, you'll need special defense that isn't covered under your basic personal vehicle plan. Discover exactly how rideshare functions and what you can do to ensure you have the ideal defense for your vehicle.

Fortunately is that you wouldn't require a different personal car policy given that a for-hire livery plan can cover you for both organization as well as individual usage. automobile. We offer for-hire livery insurance in 38 states. A lot more Information.

Your personal insurance coverage firm can reject your claim or drop you as a consumer if you lie concerning using your vehicle to make distributions. You might also be billed with insurance scams. Additionally, distribution business deal with chauffeurs as independent More help service providers, so they do not have to provide substantial insurance policy coverage, either.

If you rely upon a shipment company's insurance, you will certainly not have protection for on your own or your automobile while you are waiting on an order demand. As well as for business like Instacart as well as Grubhub, the firm does not provide insurance coverage for any point at the same time. It is likewise vital to note your individual automobile insurance will certainly not provide protection while your distribution application gets on, whether you are waiting on a request or proactively choosing up or providing.

All about Rideshare Insurance

That implies State Farm customers that drive for delivery services can miss the included cost of a company policy or rideshare add-on. If you do not have a policy with State Farm and don't intend to change, the next best means to obtain shipment insurance policy coverage is by acquiring a rideshare add-on that covers distribution driving as well.

For instance, if you drive for Instacart or Grubhub, make sure to buy a policy that will cover you despite whether you have food in the cars and truck. Commercial policies are normally a lot more pricey, yet it's much better to pay added for the right coverage than to deal with the economic effects of a mishap that is not covered by your insurance policy.

You're not covered by your personal auto policy, and also you have limited protection under your rideshare firm's insurance coverage. car. * You're covered by your rideshare firm's insurance coverage.