In a similar way, if you have a history of having auto insurance plan without filing insurance claims, you'll obtain more affordable prices than somebody who has actually submitted insurance claims in the past.: Vehicles that are driven much less often are less likely to be associated with a crash or other destructive occasion. Autos with reduced yearly gas mileage may certify for somewhat reduced rates.

To discover the best automobile insurance for you, you ought to comparison store online or talk with an insurance agent or broker - car insurance. You can, yet make certain to maintain track of the insurance coverages chosen by you as well as provided by insurers to make a reasonable comparison. Conversely, you can that can aid you discover the most effective mix of price and fit.

Independent agents function for numerous insurance provider and also can compare amongst them, while captive agents benefit just one insurance policy firm. Offered the various ranking methodologies and elements utilized by insurers, no single insurance provider will be best for everybody. To better recognize your typical automobile insurance expense, invest some time contrasting quotes across companies with your selected approach.

Prices were determined by evaluating our base profile with the ages 18-60 (base: 40 years) applied. * 2021 prices for 16-year-old are based on a chauffeur of this age included to their parents' policy. * 2021 prices for 18-year-old are based on a chauffeur of this age that is a tenant (not a homeowner) and on their very own policy.

To establish exactly how well the very best car insurance companies please these priorities, third-party agency scores from J.D - perks. Power, AM Ideal, S&P, NAIC, and Moodys had the many effect on the firms' Bankrate Scores. As cost is a common consideration for motorists, we analyzed quoted costs based on 40-year-old man and also women drivers with a 2019 Toyota Camry.

What Does How Much Car Insurance Do You Need - 4 Easy Steps Do?

cheap auto insurance affordable auto insurance vans suvs

cheap auto insurance affordable auto insurance vans suvs

It is always a great concept to ask your insurance firm if any discounts might be offered to you. The adhering to are a few of the price cuts insurance firms may use as well as to which you may be entitled:

In this article, we'll explore how average auto insurance prices by age as well as state can fluctuate. We'll likewise take a look at which of the best auto insurance coverage business provide good price cuts on cars and truck insurance by age as well as contrast them side-by-side. cheap car insurance. Whenever you look for auto insurance policy, we recommend obtaining quotes from numerous providers so you can contrast insurance coverage and prices.

Why do typical car insurance prices by age vary so much? 5 percent of the populace in 2017 yet represented 8 percent of the total price of auto crash injuries.

The price information comes from the AAA Foundation for Website Traffic Safety And Security, and also it accounts for any kind of mishap that was reported to the cops. The average premium information originates from the Zebra's State of Auto Insurance coverage report. The rates are for policies with 50/100/50 liability protection restrictions and a $500 deductible for comprehensive and accident coverage. trucks.

According to the National Freeway Website Traffic Safety Management, 85-year-old males are 40 percent more probable to enter a mishap than 75-year-old men. Checking out the table above, you can see that there is a straight connection between the collision rate for an age which age's average insurance costs.

Everything about How Auto Insurance Rates Have Changed Over The Past Decades

risks liability insurance credit score

Maintain in mind, you might find better prices through another firm that does not have a particular trainee or senior discount rate. Average Car Insurance Policy Rates As Well As Cheapest Company In Each State Because auto coverage rates vary so a lot from state to state, the service provider that uses the most inexpensive auto insurance policy in one state might not provide the most affordable protection in your state.

You'll likewise see the ordinary expense of insurance because state to aid you compare. The table likewise consists of rates for Washington, D.C. These price approximates relate to 35-year-old chauffeurs with good driving documents as well as credit history. As you can see, ordinary cars and truck insurance policy prices vary commonly by state. Idahoans pay the least for vehicle insurance coverage, while drivers in Michigan fork over the big bucks for coverage.

If you stay in downtown Des Moines, your costs will most likely be greater than the state average. On the various other hand, if you stay in upstate New york city, your cars and truck insurance coverage will likely cost less than the state average. Within states, automobile insurance coverage premiums can differ extensively city by city. insurance company.

The state isn't one of the most pricey general. Minimum Insurance coverage Demands The majority of states have economic responsibility legislations that need chauffeurs to bring minimal car insurance policy protection. You can just bypass protection in 2 states Virginia and also New Hampshire but you are still financially in charge of the damage that you trigger - car.

No-fault states include: What Various other Factors Influence Vehicle Insurance Fees? Your age and also your residence state aren't the only things that impact your rates.

How Much Car Insurance Do I Need? - State Requirements ... Fundamentals Explained

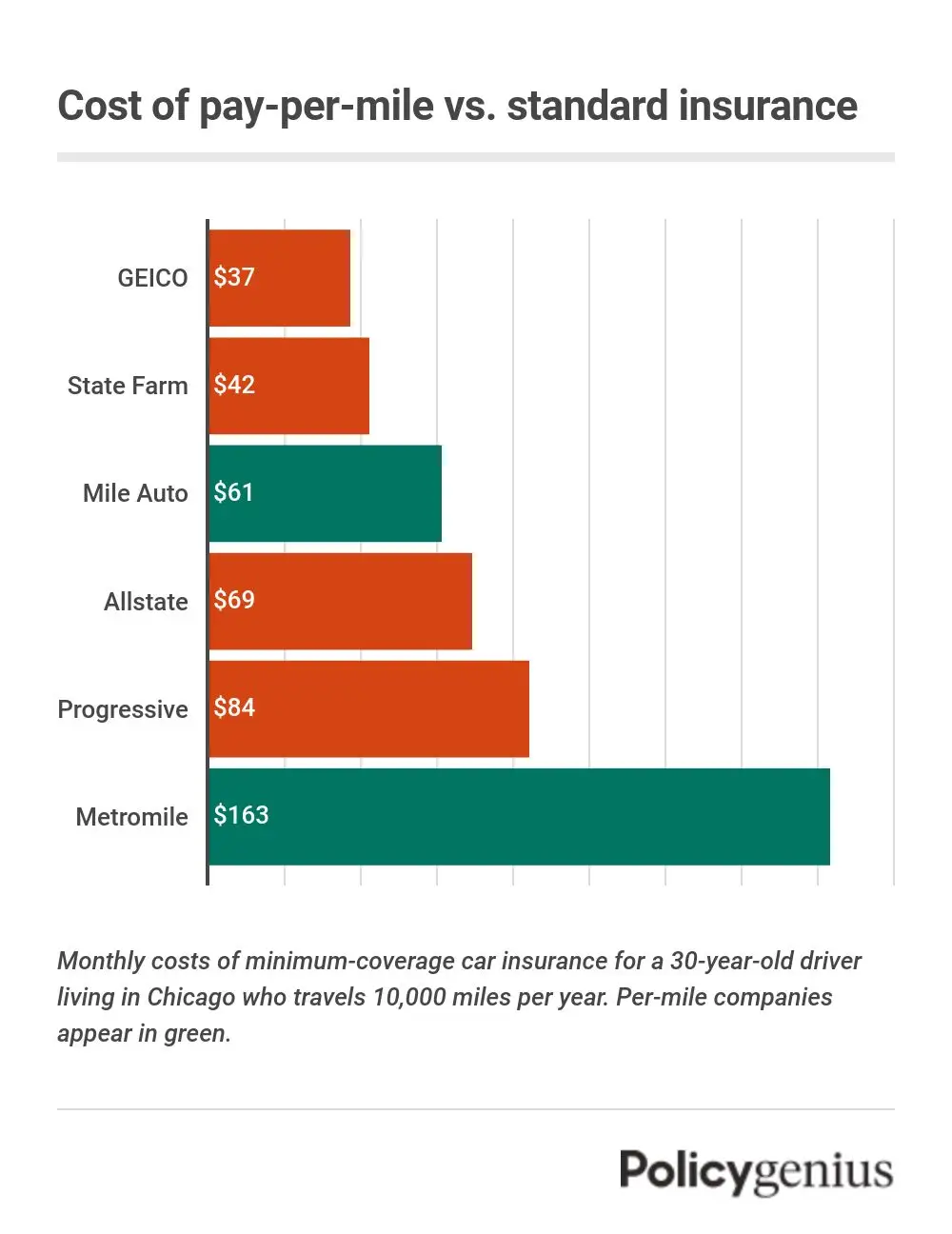

Some insurance firms may supply discounted rates if you do not utilize your cars and truck a lot. Others supply usage-based insurance that might save you money. Insurance providers factor the possibility of a lorry being taken or damaged as well as the expense of that lorry right into your premiums. If your automobile is one that has a likelihood of being taken, you might have to pay even more for insurance policy.

In others, having bad credit report can trigger the price of your insurance coverage premiums to rise significantly. Not every state permits insurance firms to use the gender provided on your chauffeur's license as a determining consider your premiums - money. But in ones that do, women drivers generally pay a little less for insurance policy than male vehicle drivers.

Policies that just satisfy state minimum coverage requirements will certainly be the most inexpensive. Additional protection will certainly set you back more. Why Do Automobile Insurance Policy Rates Change? Looking at typical vehicle insurance coverage rates by age as well as state makes you question, what else impacts rates? The answer is that vehicle insurance policy rates can change for many reasons.

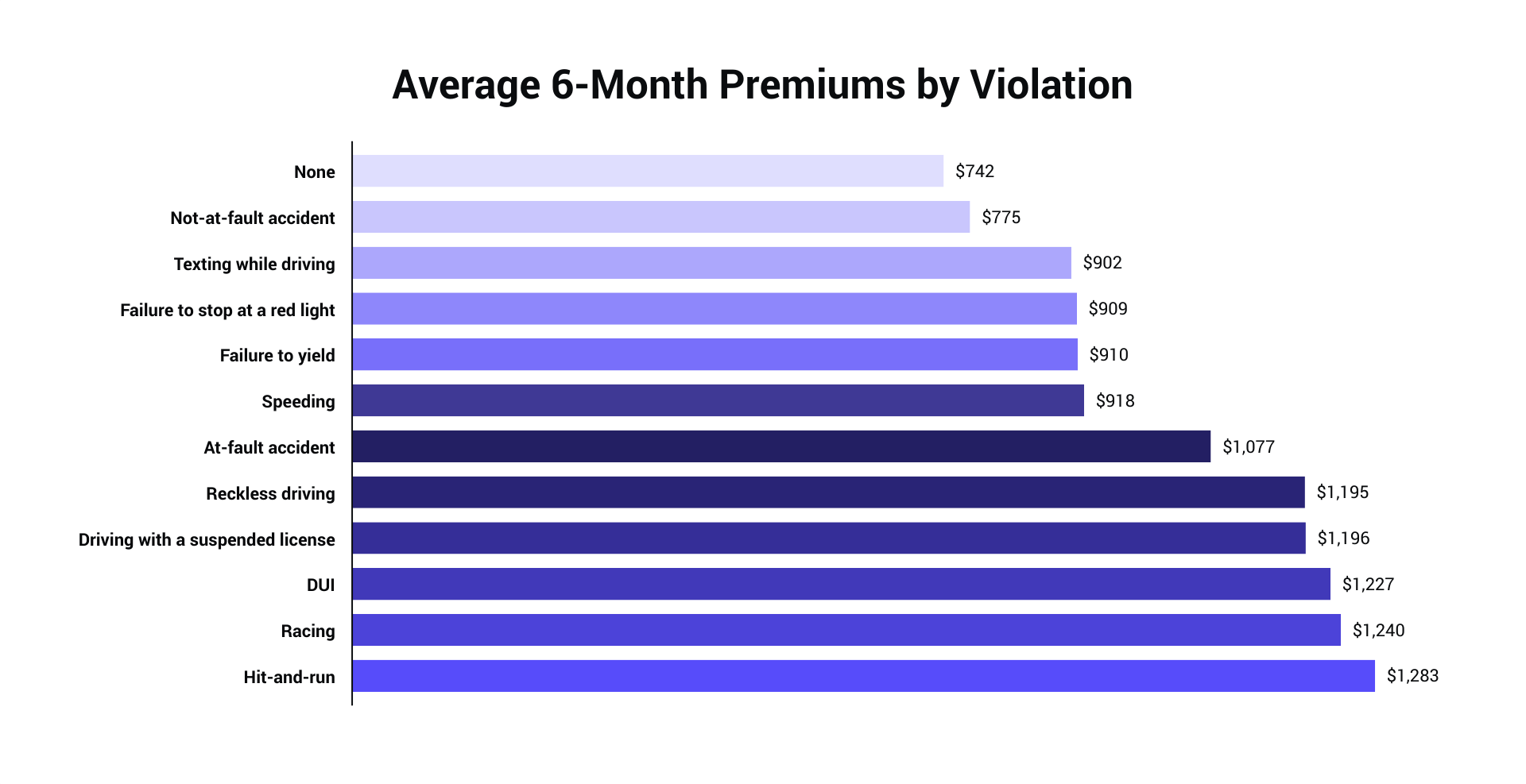

An at-fault mishap can increase your price as high as half over the following 3 years. If you were founded guilty of a DUI or perpetrated a hit-and-run, your prices will certainly increase also extra. You don't have to be in a crash to experience rising rates. Overall, auto insurance coverage tends to obtain a lot more pricey as time takes place.

There are a number of other discounts that you could be able to exploit on right now. Here are a few of them: Many companies offer you the biggest price cut for having a great driving history. Additionally called bundling, you can obtain lower rates for holding greater than one insurance coverage policy with the exact same company.

The Of How Much Is Car Insurance? Average Costs, May 2022

Home owner: If you possess a residence, you could get a home owner discount rate from a variety of companies. Get a discount rate for sticking to the very same firm for numerous years. Below's a trick: You can always contrast prices each term to see if you're obtaining the very best cost, despite having your commitment price cut.

Some can also elevate your rates if it transforms out you're not an excellent motorist. Some firms provide you a discount rate for having a great credit report. When looking for a quote, it's an excellent suggestion to call the insurance provider as well as ask if there are any kind of more discount rates that relate to you.

Below are the state minimums for physical injury and residential property damage. low cost auto. Note that some states likewise call for without insurance motorist physical injury, uninsured motorist home damages, and also personal injury protection insurance in enhancement to these minimums. Ensure you comprehend your state's laws and also insurance coverage limits prior to buying a vehicle insurance coverage plan.

$25,000/ $50,000 $10,000 West Virginia $25,000/ $50,000 $25,000 Wisconsin $25,000/ $50,000 $10,000 Wyoming $25,000/ $50,000 $20,000 1New Hampshire does not require its vehicle drivers to carry auto insurance, nevertheless, drivers need to have the ability to cover the price of property damage or physical injury as a result of an accident in which they are at fault (car insured).

Instance: If a tree branch drops on your car during a tornado, comprehensive insurance coverage may cover the damage. Crash coverage Collision insurance policy covers the expense to repair or replace your own cars and truck if you hit an additional vehicle or item.

The Best Guide To How Much Is Car Rental Insurance? - Enterprise Rent-a-car

The majority of states require you to lug liability insurance, yet accident insurance policy is not called for by law. If your cars and truck is under a loan, however, it prevails for lenders to require both extensive and collision insurance coverage. Clinical settlements Medical coverage on an automobile insurance coverage plan covers you and any person else in your lorry at the time of a crash (insurers).

When shopping around for automobile insurance coverage, look right into the particular advantages each firm provides they might be well worth the included price. Deductibles are a typical attribute of insurance policies.

: If you choose a $500 deductible as well as obtain right into an accident that calls for $2,000 in fixings, you would certainly pay Go here the initial $500 and also your insurance would certainly pay the continuing to be $1,500. If you have a crash with just $400 in damages, you would certainly have to pay the entire expense, as it's reduced than the $500 deductible.

Just how is auto insurance coverage valued? Auto insurance policy prices are rather intricate, but it's easy to break down the various aspects that identify your rates. Right here are a few of the significant elements that enter into guaranteeing a cars and truck and its chauffeur: Vehicle driver age: Younger drivers usually pay greater than older drivers. cheaper cars.

Driving history: If you have either a background of accidents or tickets, you can expect to pay even more for insurance policy. Drivers with higher credit history scores usually get reduced prices.

Unknown Facts About How Much Is Car Insurance? - Liberty Mutual

Some insurers offer per-mile insurance where you pay less for driving less. Insurance coverage choices: When you choose your insurance deductible as well as protection levels, your insurance coverage costs will go up or down with your choices (cheapest car insurance).

Somebody with an elegant new red cars will most likely pay a whole lot even more than a similar motorist with a dull 10-year-old car. Discounts: Every insurance policy company has its very own rules around discount rates. There prevail discounts for multiple plans at the very same insurance provider, a great driving history, a reduced claim background, including lorry security as well as anti-theft features, automatic repayments, great students, and also others.

Every insurer has its own proprietary rates and also formulas for determining what clients pay. auto. Buying around can help you conserve a tiny fortune in many cases. If you can not manage vehicle insurance policy, you shouldn't just drive without it, as it can be both unlawful and a significant threat to your finances.

vehicle insurance cheap insurance vehicle insurance cheaper cars

vehicle insurance cheap insurance vehicle insurance cheaper cars

Yes, The General car insurance policy offers complete coverage for drivers. Full coverage implies the chauffeur desires greater than simply responsibility protection. Complete coverage consists of not just comprehensive and accident insurance policy, but without insurance or underinsured motorist insurance coverage. While the majority of states don't need you to acquire uninsured or underinsured motorist coverage, it's a great concept (liability).